Alina Selyukh, NPR News.Ĭopyright © 2023 NPR. Maybe this buys time and goodwill for yet another lifeline and keeps the basement door closed for now because in bankruptcy is when shares really can become worthless. It's a financial trick that fuses a bunch of shares into a single one, meaning fewer shares are out there, but each one is more valuable than before, maybe no longer worth pennies but back to a few dollars. SELYUKH: The company's latest gambit is called a reverse stock split. And so Bed Bath is throwing every Hail Mary to avoid that.ĭAMODARAN: Thinking about every exit hatch that they can find because you're on life support here. Getting delisted doesn't automatically mean shares hit zero and stop trading, but they usually go to a sort of dodgy flea market of stocks, what's known as over-the-counter markets - not a place for prominent, healthy companies. The Nasdaq, the exchange where Bed Bath shares are listed, will eventually kick out a company whose stock price stays under a dollar for too long. You know, a pop from 35 cents to 70 cents - it's still a 70-cent stock, but you've gotten 100% return. That leaves mostly speculators, chasers of a quick profit.ĭUQUESNAY: It's pretty easy for a stock to move a couple of cents, and that's a big percentage gain. Even traders who bet against the company are usually gone by the time you hit penny stock. SELYUKH: Given months of bankruptcy warnings, these are long odds, which is why duQuesnay suspects at this point, people trading Bed Bath shares probably aren't really thinking of the company's long-term future. SELYUKH: As long as someone is out there in the market betting that Bed Bath is worth something, maybe it will turn around or even get acquired.ĭUQUESNAY: They are going to have a price, even if it's one penny. SELYUKH: But as long as there's a glimmer of hope for Bed Bath, duQuesnay says.ĭUQUESNAY: It's pretty hard for a stock that's still trading to actually hit zero.

#Bed bath and beyond stock prices movie

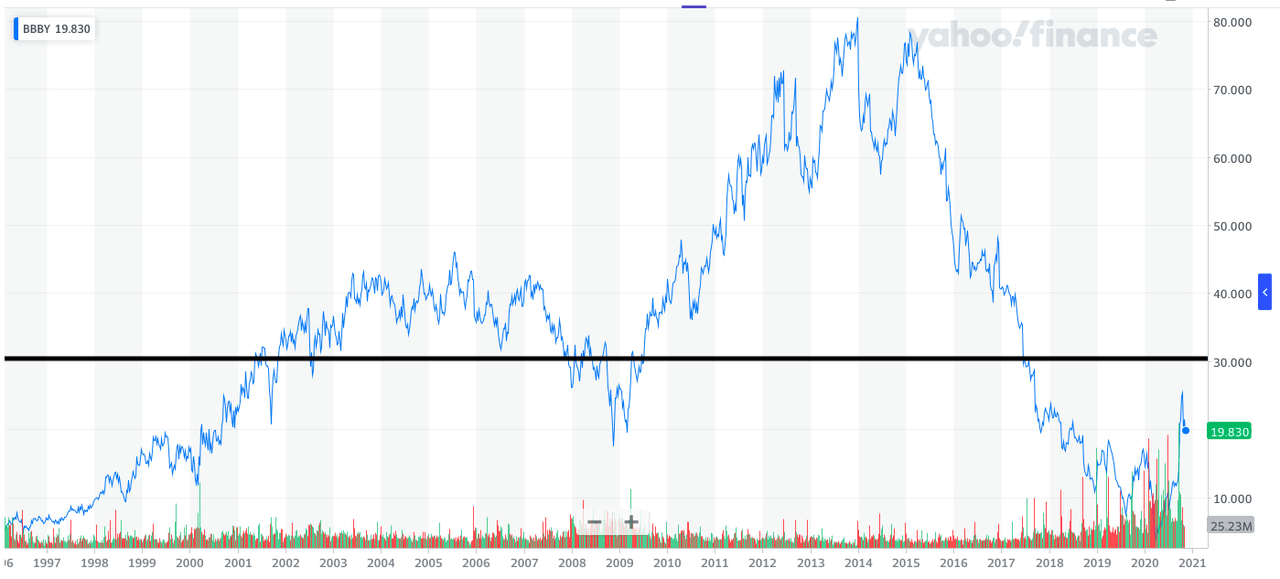

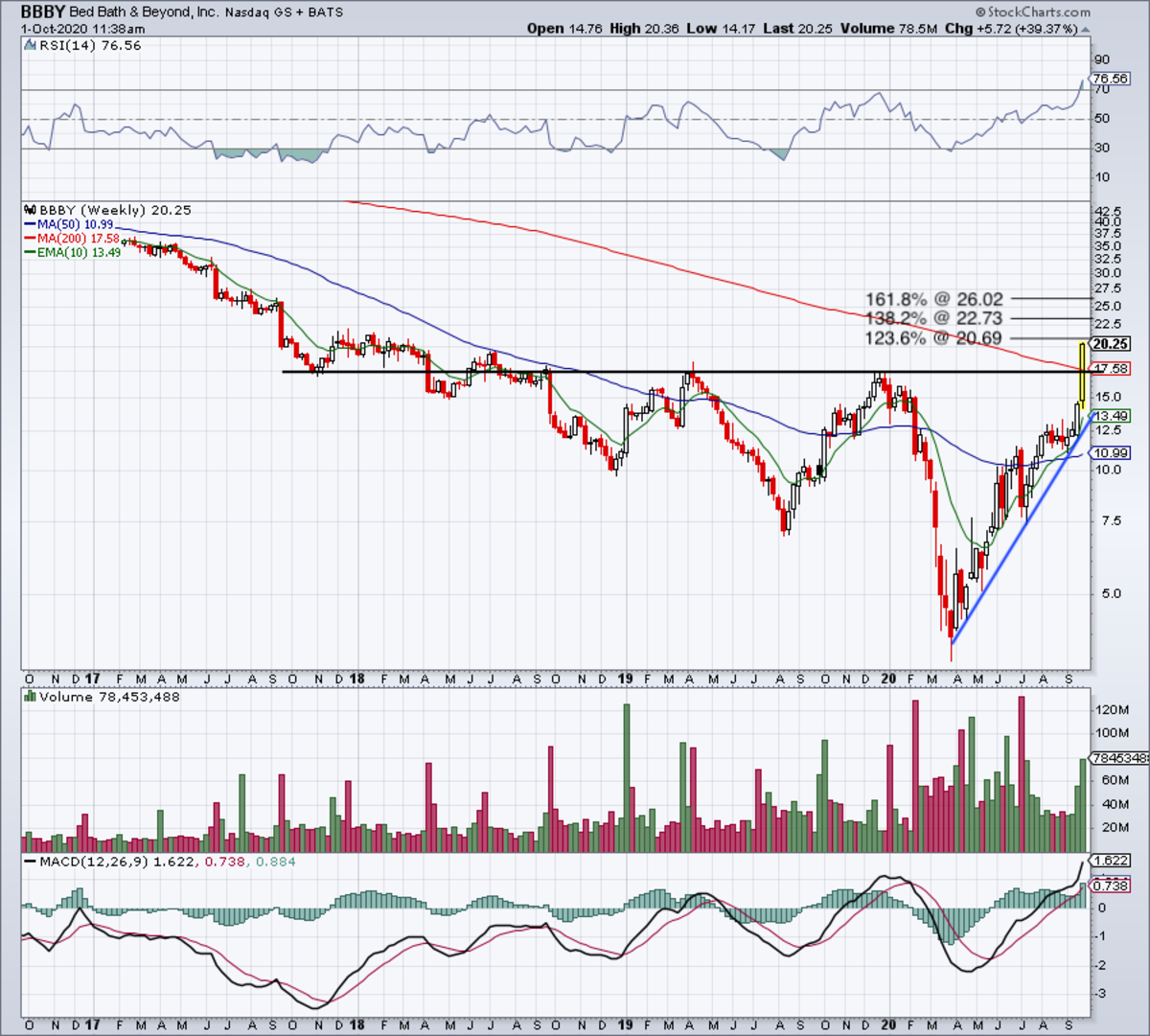

And they do what every horror movie character does, which is open the basement door.ĭAMODARAN: You know this isn't going to end well. Damodaran has an ominous view of its chances.ĭAMODARAN: Bed Bath & Beyond at this point resembles that character in a horror movie, the teenage boy or girl who pauses outside the door to the basement. Bed Bath still has a few hundred stores and the Buybuy Baby chain, but it's been facing pretty fundamental problems - losing shoppers and, therefore, money, struggling to compete online and lately to even keep its shelves stocked. SELYUKH: Aswath Damodaran is a finance professor at New York University. Rinse repeat.ĪSWATH DAMODARAN: At this point, you're getting what I call the desperation capital. It's Bed Bath fighting for survival, warning of a bankruptcy again and again, then getting a lifeline from a lender or an investor. SELYUKH: Blair duQuesnay is a senior adviser at Ritholtz Wealth Management. Is all it takes to be a Bed Bath & Beyond shareholder.īLAIR DUQUESNAY: We call this a penny stock when we're trading below a dollar. But how low can this stock or any stock actually go? NPR's Alina Selyukh reports.ĪLINA SELYUKH, BYLINE: Ten years ago, the stock price of Bed Bath & Beyond reached $80. Of course, that's a sign of a company in trouble, near bankruptcy. Buying one share of Bed Bath & Beyond today costs around 30 cents.

0 kommentar(er)

0 kommentar(er)